Pay and piece rates

Avoid costly mistakes – use the information and resources on this page to get wages right.

On this page:

- Pay rates

- Entry level classifications

- Hourly rates

- Piece rates – Horticulture Award

- Piece rates – Wine Award

- Tax and superannuation

See also:

Pay rates

Employees in the horticulture industry are usually covered by the Horticulture Award or Wine Award.

An award is a legal document that sets minimum pay rates and other entitlements, like leave and overtime. Awards can also have rules about when an employee must be paid hourly or piece rates.

Labour hire workers can be covered by these awards.

Employees under the Horticulture Award or Wine Award can be paid:

- hourly rates

- piece rates, or

- both hourly and piece rates.

Example: Paid a piece rate and an hourly rate

Nick is a fruit-picking employee under the Horticulture Award.

In the morning, Nick is paid a piece rate for picking oranges. This is covered by his piecework record.

In the afternoon, Nick picks apples and packs oranges. These tasks aren’t covered by his piecework record. For the time Nick spends on these tasks, he is paid an hourly rate. This rate is at least the minimum hourly rate for his classification under the Award.

Check what award an employee is covered by using our Pay and Conditions Tool.

Paid for all time worked

Employers must pay employees for all work they do. This includes for:

- training

- meetings

- mandatory work activities.

Employers can face significant penalties if they don't pay employees their correct pay and entitlements.

Learn more about the rules for hourly rates and piece rates at:

Tip: Voluntary Small Business Wage Compliance Code (Code)

Use the Code and our supporting guide to make sure employees are being paid correctly. Our guide offers practical advice and tools including a handy checklist, case studies and best practice tips.

For more information, visit Voluntary Small Business Wage Compliance Code.

Entry level classifications

An employee’s classification is based on their duties and experience. An employee must be paid based on their classification.

For information on how to read and apply classification descriptions, visit Award classifications.

Horticulture Award

Employees can only be employed as a Level 1 under the Horticulture Award for a maximum of 3 months. This gives the employee time to gain the basic skills and experience required in the industry.

For employees who have worked in the horticulture industry before, the time spent working in the industry counts towards the 3 months.

Example: Employee gaining industry experience

Sofia has recently started working for a grower in the horticulture industry.

The farm is quite large and grows several types of vegetables. Sofia has never worked in the industry before so starts work as a Level 1 employee.

Sofia’s duties include picking and washing vegetables plus other general duties on the farm.

After working in this role for 3 months, Sofia progresses to the Level 2 classification.

Example: Previous industry experience counts in new job

Chas is a fruit picker in Queensland on a working holiday. They have been working on a pineapple farm for the last 6 months.

Chas’ duties have included fruit picking, pruning and other general labour duties on the farm. After 3 months, Chas moves to the Level 2 classification.

Chas decides that they would like to continue their working holiday and moves to the Riverina region in New South Wales. They start work on a citrus farm.

Even though this is a new job, Chas’ previous 6 months experience in the horticulture industry still counts as experience in their new job. They are hired as a Level 2 employee.

You can read more about progression in our Library article, Classification progression for Level 1 Horticulture Award employees.

Wine Award

The Wine Award has entry level, Grade 1, classifications.

Employees will progress to a Grade 2 when they have completed the required training and have the skills to perform the role.

Hourly rates

Employees can be paid an hourly rate for each hour they work. You can check minimum hourly pay rates and allowances by using our Pay Calculator. You can also download the award pay guides from Pay guides.

Examples of minimum hourly pay rates

| Type of work | Award | Minimum hourly rate (adult full-time level/grade 1 employee) | Minimum hourly rate (adult casual level/grade 1 employee) | Piece rates allowed | Minimum wage guarantee for pieceworkers |

|---|---|---|---|---|---|

| Planting, picking, sorting and packing fruit and vegetables | Horticulture Award | $24.28 (from 1 July 2025) | $30.35 (from 1 July 2025) | Yes | Yes |

| Working in vineyards picking wine grapes or pruning wine grape vines | Wine Award | $24.62 (from 1 July 2025) | $30.78 (from 1 July 2025) | Yes | No |

Employers can face significant penalties if they don't pay employees their correct pay and entitlements. The current maximum penalties a court may impose where contraventions relate to an underpayment, are:

- $19,800 per breach for an individual

- $99,000 per breach for a company with less than 15 employees, or

- $495,000 per breach for a company with 15 or more employees.

Where an employer knowingly or recklessly underpays their employee, a court can impose a penalty up to 10 times higher for a ‘serious contravention’.

For more information about penalties, go to Litigation.

Piece rates – Horticulture Award

Tip: Piecework checklist

Employers can use our free Piecework arrangements employer checklist (DOCX) (PDF) to help ensure they’re meeting the rules for piece rates.

A piece rate is where an employee gets paid by the piece. It's based on the amount the employee has picked, packed, pruned or made. Employees getting piece rates are paid by output. For example, the number of kilograms or bins of produce picked.

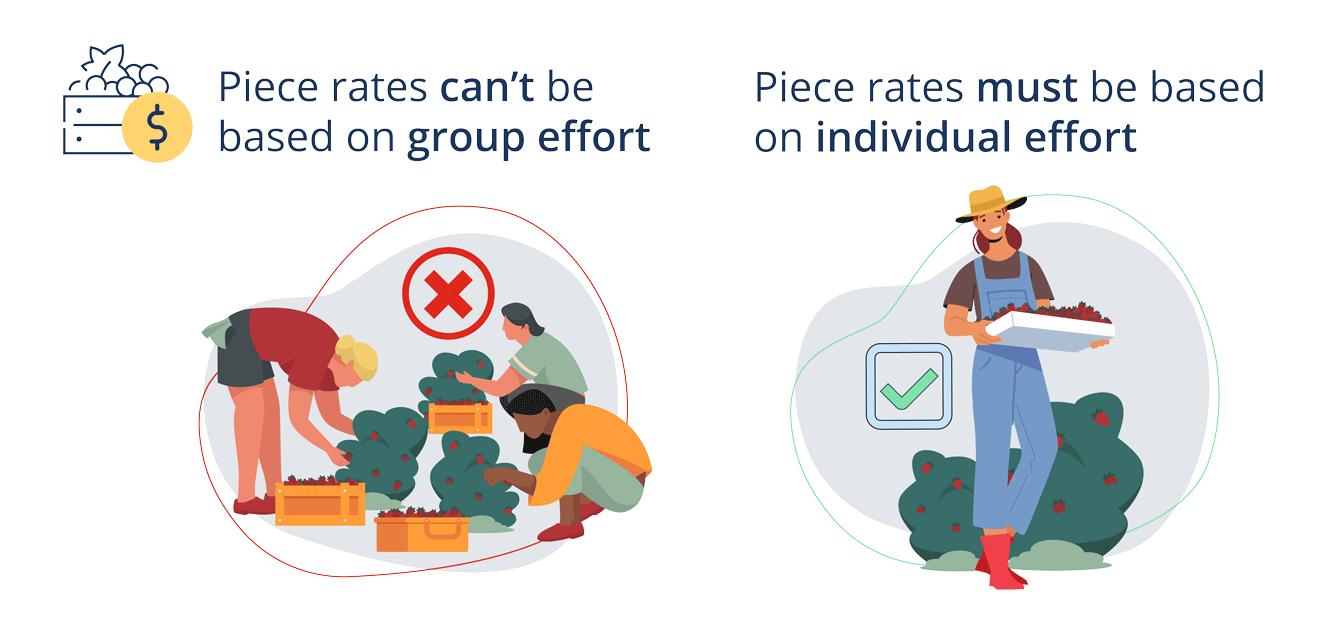

A piece rate is based on individual effort only – not on group effort.

Image reminding employers and employees that piece rates are based on individual effort. They can’t be based on group effort.

Under the Horticulture Award there:

- is a minimum wage guarantee for each day that pieceworkers work

- are requirements for setting piece rates

- are requirements for using piece rates.

Minimum wage guarantee for pieceworkers

Image showing that from the first pay period that starts on or after 28 April 2022 pieceworkers must get at least the minimum wage guarantee.

Full-time, part-time and casual employees who are paid a piece rate under the Horticulture Award have a minimum wage guarantee for each day that they work.

This means that for each day that they work, a pieceworker has to be paid at least the ‘hourly rate for the pieceworker’, multiplied by the number of hours worked on that day.

The ‘hourly rate for the pieceworker’ means the minimum hourly rate for the pieceworker’s classification level. For casual employees, this includes the 25% casual loading.

If the pieceworker would earn more than the minimum wage guarantee for their day’s work under the piece rate, they have to be paid that higher amount.

Examples of the minimum wage guarantee

| Type of employee | Minimum wage guarantee |

|---|---|

| Level 1 full-time and part-time employees | Under the Horticulture Award, the hourly rate for a full-time and part-time level 1 employee is $24.28 per hour. If this employee works 7.6 hours per day, their minimum wage guarantee is $184.53 per day ($24.28 x 7.6). |

| Level 1 casual employees | Under the Horticulture Award, the hourly rate for a casual adult level 1 employee is $30.35 per hour ($24.28 + 25% casual loading). If this employee works 7.6 hours per day, their minimum wage guarantee is $230.66 per day ($30.35 x 7.6). |

Employees with more than 3 months experience must progress to a Level 2 classification. You can find these rates by using our Pay and Conditions Tool.

Employers can use our templates to record an employee’s hours of work and piece rate and complete piecework reconciliations:

Requirements for setting piece rates

A piece rate has to allow a pieceworker working at the ‘average productivity of a pieceworker competent at the piecework task’ to earn at least 15% more than the hourly rate for the pieceworker.

The ‘hourly rate for the pieceworker’ is the minimum hourly rate in the Horticulture Award for the pieceworker’s classification level. For casual pieceworkers, it includes the 25% casual loading.

The Horticulture Award also tells you how to work out the ‘average productivity of a pieceworker competent at the piecework task’.

Examples of calculating the 15% rule for setting piecework rates

| Type of employee | Piece rate requirements |

|---|---|

| Level 1 full-time and part-time employees | Under the Horticulture Award, the hourly rate for a full-time and part-time level 1 employee is $24.28 per hour. The piece rate has to allow the pieceworker, working at the average productivity of a competent pieceworker, to earn at least $27.92 per hour. This is the hourly rate of $24.28, plus 15% of that rate. |

| Level 1 casual employees | Under the Horticulture Award, the hourly rate for a casual adult level 1 employee is $30.35 per hour ($24.28 + 25% casual loading). The piece rate has to allow the pieceworker working at the average productivity of a competent pieceworker to earn at least $34.90 per hour. This is the casual hourly rate of $30.35, plus 15% of that rate. |

Find out more, including how to work out the ‘average productivity of a pieceworker competent at a piecework task’, at:

Requirements for using piece rates

There are requirements for using piece rates under the Horticulture Award:

- if an employer uses piece rates to pay their employees, they should be able to show how they calculated their piece rates

- piece rates have to be set before a piecework record is made

- a piecework record has to be made, signed and given to the employee before the piecework starts

- piece rates should be reviewed regularly

- a pieceworker is paid 200% of the piece rate for work on a public holiday.

Employers can’t:

- ask workers to overload buckets or bins

- ask workers to pick bad produce for free

- apply group rates, where a group of workers is paid at a combined rate.

Find out more at:

Looking for historical information? Access our historical guidance on piecework rates under the Horticulture Award in our Library article Piecework in the Horticulture Award prior to 28 April 2022.

Piece rates – Wine Award

A piece rate is where an employee gets paid by the piece. For example, the number of grape bunches an employee has picked.

Under the Wine Award, an agreed piecework rate must allow an employee of ‘average capacity’ to earn at least 20% more per hour than the relevant minimum hourly rate in the award for the employee’s employment type and classification.

Learn more about piece rates at How to use piece rates – Wine Award.

Tax and superannuation

Employees in Australia need to pay tax even if they are paid in cash.

Employees in Australia need a Tax File Number (TFN) and need to give it to their employer. Where required, the employer needs to withhold and remit tax from their employee’s pay to the Australian Taxation Office (ATO).

Employees who meet certain requirements must be paid superannuation by their employer. If a worker is on a temporary visa, they may be able to claim this payment when they leave.

The ATO gives advice about tax and superannuation. Find out more on the ATO website:

For growers:

- Australian Taxation Office - Working out if you have to pay super

- Australian Taxation Office - Super for employers

For employees:

Authorised by the Australian Government, Canberra

Resources

GROWER RESOURCES

Voluntary Small Business Wage Compliance Code

Guide to paying employees correctly and the Voluntary Small Business Wage Compliance Code (PDF)(DOCX)Guide to paying employees correctly and the Voluntary Small Business Wage Compliance Code

For the horticulture industry:

Piecework arrangements employer checklist (DOCX) (PDF)

Piecework record template (DOCX) (PDF)

Piecework timesheet template (DOCX) (PDF)

Piecework reconciliation template (DOCX) (PDF)

For the wine industry:

WORKER RESOURCES

For the horticulture industry:

Piecework rules have changed information sheet (DOCX) (PDF) (For translated information sheets, see Migrant workers)